Rezolve Expands Board With Two Additional Members Bringing Experience In Payments, E-Commerce

On December 17, 2021, Rezolve announced that it had entered into a definitive business combination agreement with Armada Acquisition Corp. I (NASDAQ: AACI), a publicly traded special purpose acquisition company. Upon closing of the transaction, the combined company’s shares are expected to trade on the NASDAQ under the ticker symbol “RZLV”.

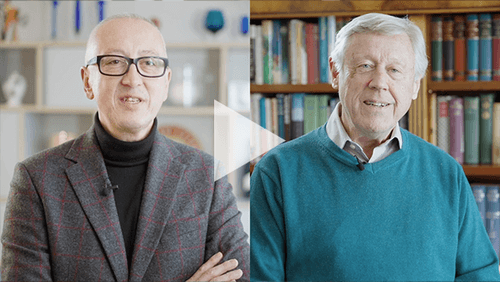

“We are pleased to welcome Perry and Smith to the board,” said Daniel Wagner, Rezolve’s chairman and CEO. “Their expertise in devising and implementing payments and e-commerce strategies across both Europe and Asia will extend the Board’s breadth of knowledge and experience, and will be a tremendous asset as we expand our presence globally in the coming years.”

“I was delighted when Daniel approached me to join the board and I am very excited to be working with him,” Smith said. “Markets in Asia are very diverse and challenging, and I am impressed with Rezolve’s go-to-market model using intermediaries to get access both to the merchants and the final consumers. Rezolve’s approach of growing revenue very rapidly through these partners is the right strategy to win in the technology space, and I look forward to helping with implementation of this approach.”

About Rezolve

About Armada Acquisition Corp. I

Important Information About the Proposed Transaction with Armada Acquisition Corp. I and Where to Find It

This communication relates to the proposed business combination transaction among Armada, Rezolve, Cayman NewCo, and Cayman Merger Sub, Inc. A full description of the terms of the transaction will be provided in a registration statement on Form F-4 that Armada intends to file with the SEC that will include a prospectus of Cayman NewCo with respect to the securities to be issued in connection with the proposed business combination and a proxy statement of Armada with respect to the solicitation proxies for the special meeting of stockholders of Armada to vote on the proposed business combination. Armada urges its investors, stockholders and other interested persons to read, when available, the preliminary proxy statement/ prospectus as well as other documents filed with the SEC because these documents will contain important information about Armada, Rezolve, Cayman NewCo and the transaction. After the registration statement is declared effective, the definitive proxy statement/prospectus to be included in the registration statement will be mailed to shareholders of Armada as of a record date to be established for voting on the proposed business combination. Once available, shareholders will also be able to obtain a copy of the Registration Statement on Form F-4, including the proxy statement/prospectus included therein, and other documents filed with the SEC without charge, by directing a request to: Armada Acquisition Corp. I, 2005 Market Street, Suite 3120, Philadelphia, PA 19103 USA; (215) 543-6886. The preliminary and definitive proxy statement/prospectus to be included in the registration statement, once available, can also be obtained, without charge, at the SEC’s website (www.sec.gov). This communication does not contain all the information that should be considered concerning the proposed business combination and is not intended to form the basis of any investment decision or any other decision in respect of the business combination. Before making any voting or investment decision, investors and security holders are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed business combination as they become available because they will contain important information about the proposed transaction.

No Offer or Solicitation

Participants in Solicitation

Forward-Looking Statements

Contacts

Investor Contact:

Kevin Hunt

Re*******@ic****.com”>Re*******@ic****.com

Media Contact:

Urmee Khan

ur*******@re*****.com

44-7576-094-040

Media Contact:

Edmond Lococo

ICR Inc.

Re*******@ic****.com“>Re*******@ic****.com